Bond Connect Sets New Record for Monthly Trading Volume

15 December 2022

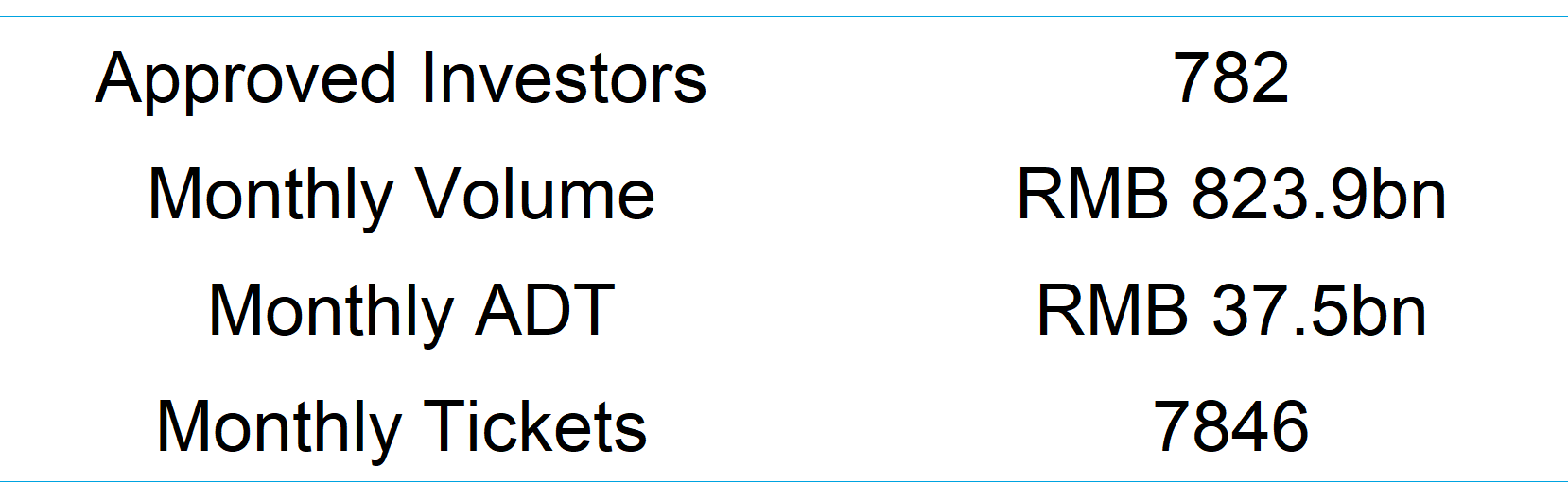

Highlights of the Month

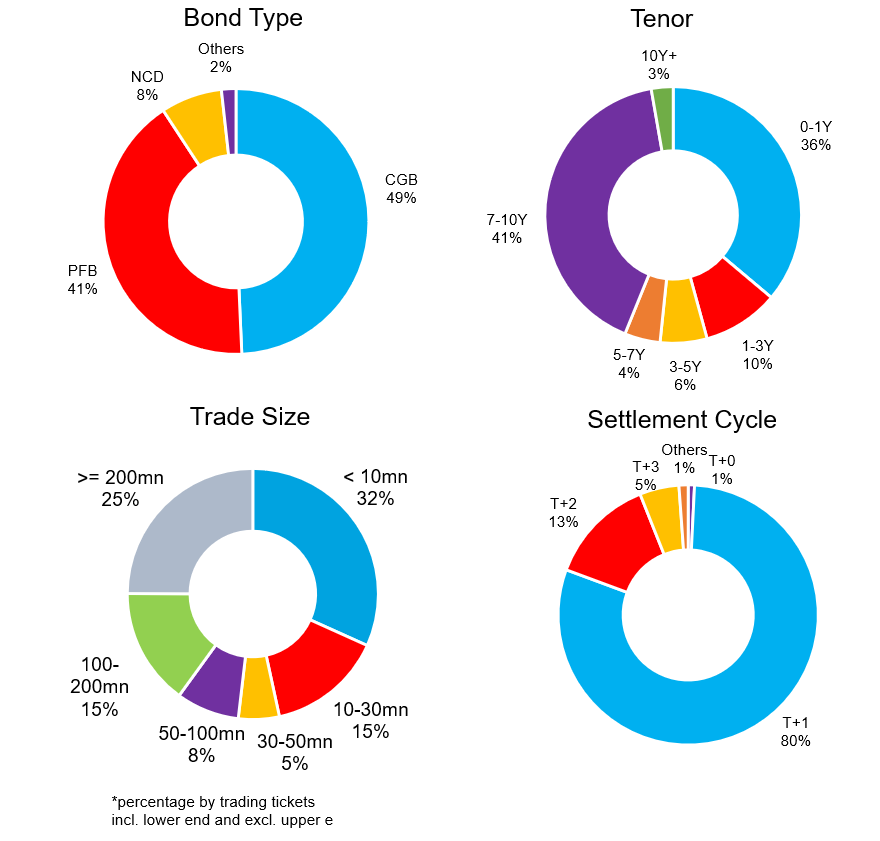

- Monthly trading volume of Northbound Bond Connect reached a new record high of RMB 823.9 billion, with monthly average daily turnover rising to RMB 37.5 billion. Chinese government bonds and policy financial bonds remained as the most popular bond types, accounting for 49% and 41% of the trading volume respectively. In terms of tenor, 7-10Y (41%) and 0-1Y (36%) are most popular.

- ePrime facilitated Huzhou Nanxun Zhenxun Sewage Treatment Co., Ltd.’s successful issuance of RMB 350 million China (Shanghai) Pilot Free Trade Zone 3-year bond on November 29, 2022. The bond will have the benefit of an irrevocable standby letter of credit issued by Bank of Hangzhou Co., Ltd. Huzhou Branch. The transaction was executed on ePrime with Orient Securities (Hong Kong) Limited and BOSC International Company Limited as Joint Global Coordinators, Joint Lead Managers and Joint Bookrunners.

- Co-hosted by BCCL and Bloomberg on November 2, the event “Prospects of Northbound Bond Connect: Trends & Enhanced Infrastructure” discussed the investment opportunities of Chinese government bonds and other RMB bond types amid the backdrop of volatilities in global markets. The panel session was joined by Mirae Asset Global Investments, Ping An Bank and Premia Partners in exploring future capital flows beyond government bonds, China economic development and primary market opportunities.

- BCCL and Fitch co-hosted an event, “Seeking Opportunities in Times of Transition” on November 16. It was joined by leading experts from HKEX, DBS, and Bank of China, delving into the medium-term outlook for China economy and RMB internationalization, as well as the 2023 outlook on Chinese local government bonds and LGFVs.

- PMIP disclosed the pre- and post-issuance information of 107 primary bonds in November, including policy financial bonds, financial bonds, tier-2 capital bonds and green bonds.