Bond Connect Flash Report - June 2025

22 July 2025

Highlights of the Month

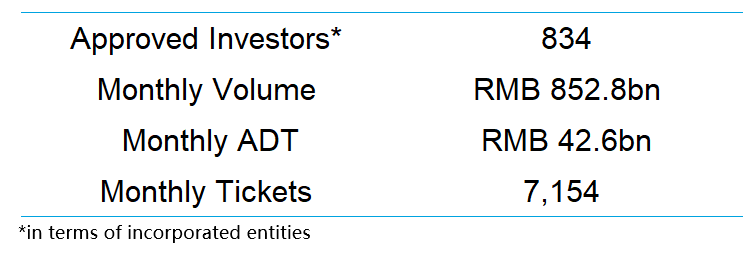

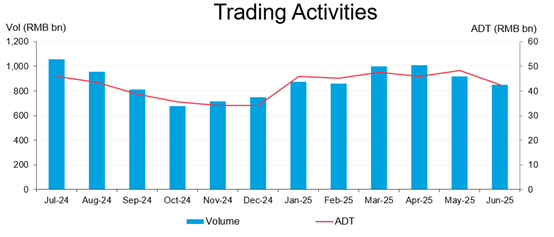

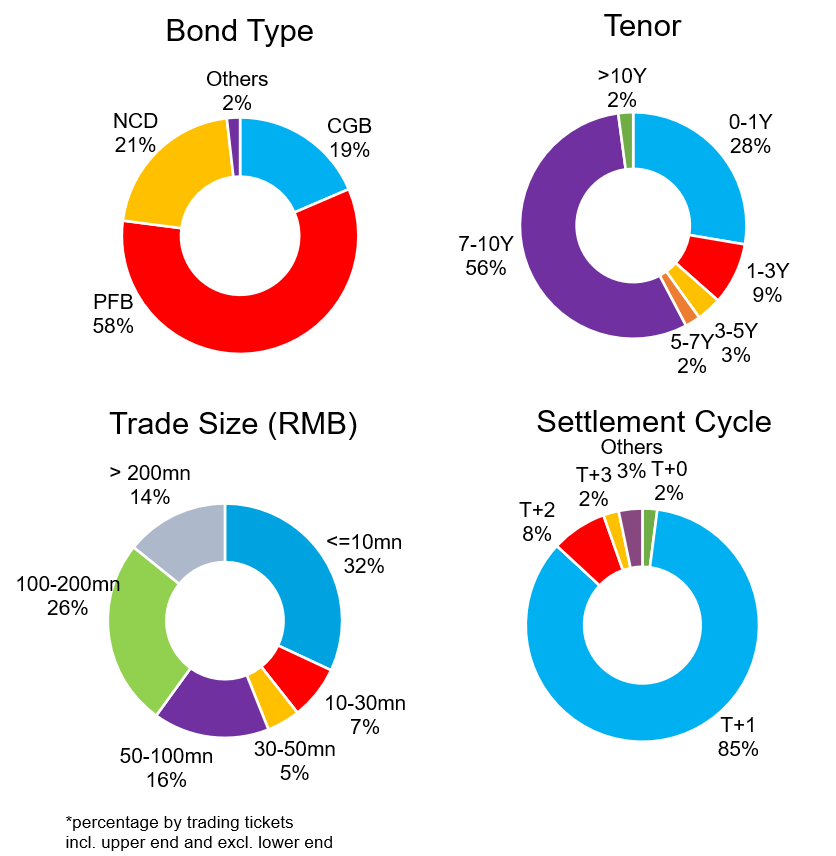

- Northbound Bond Connect: The monthly trading volume of June was RMB 852.8 billion, and the monthly average daily turnover stood at RMB 42.6 billion. Policy financial bond and negotiable certificates of deposit were the most popular bond types, accounting for 58% and 21% of the trading volume respectively.

- Northbound Swap Connect: 578 transactions were traded in June 2025, with volume of RMB 285.979 billion. By the end of June, 82 overseas institutions were onboarded under Northbound Swap Connect.

- ePrime Issuance Service successfully facilitated 12 issuances with total issue size of RMB 15.569 billion equivalent in June. Participating underwriters of this month, listed in alphabetical order, included Bank of China, China CITIC Bank International, China Industrial Securities International, China International Capital Corporation, China Securities International, CITIC Securities, CNCB Capital, Guotai Junan International, Huatai International, ICBC International, Orient Securities (Hong Kong), and TF International.

- On 16 June, BCCL was invited to attend the "Seminar on Bond Market Connectivity" hosted by the Monetary Authority of Macao, where it served as a keynote speaker. BCCL shared insights on the current development of the China Interbank Bond Market and the Bond Connect Scheme between Mainland China and Hong Kong, targeting Macao financial institutions.

- On 17 June, BCCL was invited by Bloomberg to serve as a panel moderator at an event themed “Invest in Asia Series: Spotlight on China” in Singapore. The event focused on the opportunities in China’s bond market, sharing the enhancement of financial infrastructure services and connectivity schemes, and the asset reallocation strategies for investors.

- PMIP disclosed the pre- and post-issuance information of 58 primary bonds in June.

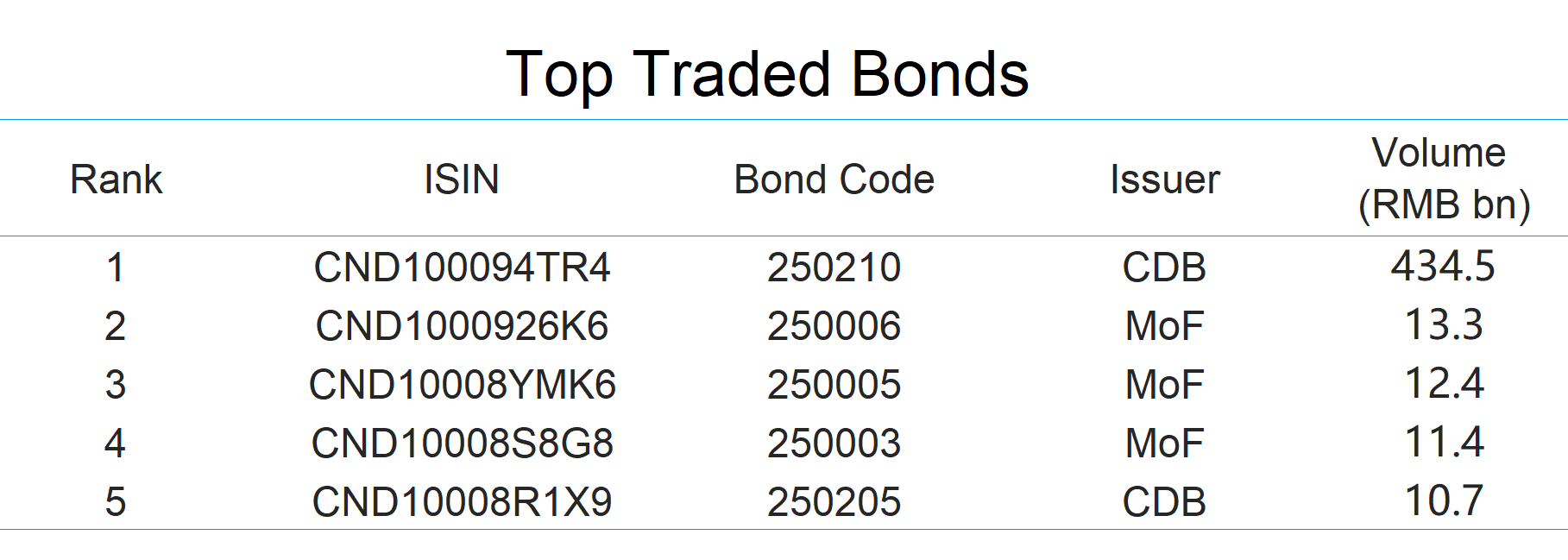

Northbound Bond Connect Investors and Trading Data

© 2025 Bond Connect Company Limited. All rights reserved.

Disclaimer:

Disclaimer:

The information contained in this document is for general informational purposes only and does not constitute an offer, solicitation, invitation or recommendation to buy or sell any securities or to provide any investment advice or service of any kind. This document is not directed at, and is not intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject any of Bond Connect Company Limited ("BCCL") and/or its affiliates to any registration requirement within such jurisdiction or country.

No section or clause in this document may be regarded as creating any obligation on BCCL and/or its affiliates. Rights and obligations with regard to the trading and settlement of any securities effected on the CFETS, including through the Bond Connect, shall be set out solely in the applicable rules of the Entities, as well as the applicable laws, rules and regulations of Mainland of China and Hong Kong in effect from time to time.

Although the information contained in this document is obtained or compiled from sources believed to be reliable, BCCL and/or its affiliates assume no responsibility or liability for any errors, omissions or other inaccuracies in the information or for the consequences thereof. **It should not be used as a substitute for investment, accounting, tax, legal or other professional advice. If you are in any doubt about the contents of this document, you should seek independent professional advice.**BCCL and/or its affiliates assume no responsibility or liability for any cost, expense, loss or damage, directly or indirectly, howsoever caused, of any kind, arising from the use of or reliance upon any information provided in this document, or in the presentation given.

**Forward-looking statements: This document may contain forward-looking statements, including but not limited to projections, estimates, forecasts, and opinions. These statements are based on assumptions and are subject to risks and uncertainties that could cause actual results to differ materially. BCCL and/or its affiliates do not undertake any obligation to update these statements in light of new information or future events. **

No section or clause in this document may be regarded as creating any obligation on BCCL and/or its affiliates. Rights and obligations with regard to the trading and settlement of any securities effected on the CFETS, including through the Bond Connect, shall be set out solely in the applicable rules of the Entities, as well as the applicable laws, rules and regulations of Mainland of China and Hong Kong in effect from time to time.

Although the information contained in this document is obtained or compiled from sources believed to be reliable, BCCL and/or its affiliates assume no responsibility or liability for any errors, omissions or other inaccuracies in the information or for the consequences thereof. **It should not be used as a substitute for investment, accounting, tax, legal or other professional advice. If you are in any doubt about the contents of this document, you should seek independent professional advice.**BCCL and/or its affiliates assume no responsibility or liability for any cost, expense, loss or damage, directly or indirectly, howsoever caused, of any kind, arising from the use of or reliance upon any information provided in this document, or in the presentation given.

**Forward-looking statements: This document may contain forward-looking statements, including but not limited to projections, estimates, forecasts, and opinions. These statements are based on assumptions and are subject to risks and uncertainties that could cause actual results to differ materially. BCCL and/or its affiliates do not undertake any obligation to update these statements in light of new information or future events. **