- Cross-Boundary Bond Repo

- Rules & Policy

- Access Application Guidance

- Trading & Clearing Mechanism

- Onshore Market Makers

- Offshore RMB Bond Repo

- Rules & Policy

- Access Application Guidance

- Trading & Settlement Mechanism

- Offshore Market Makers

Cross-Boundary Bond Repo Overview

To further facilitate liquidity management for overseas institutional investors, Northbound Bond Connect Investors can use their onshore bond holdings as collateral for participating in Cross-Boundary Bond Repo Business.

Trading Participants

Overseas institutional investors who are eligible to conduct cash bond trading under Northbound Bond Connect. The eligibility of overseas institutional investors participating in the Cross-Boundary Repo Business is governed by Joint Announcement of PBOC, CSRC and SAFE (No. 21 [2025]); Joint Announcement of CFETS, CCDC, and SHCH on Supporting Overseas Institutional Investors in Conducting Bond Repurchase Business in the Interbank Bond Market (No. 372 [2025]) and other related Rules and Policy.

Overseas institutional investors accessing CIBM via Northbound Bond Connect shall conduct interbank bond repo transactions with onshore market makers recognized by the PBoC.

Overseas institutional investors accessing CIBM via Northbound Bond Connect shall conduct interbank bond repo transactions with onshore market makers recognized by the PBoC.

Eligible Onshore Bonds

All Cash Bonds held by overseas institutional investors under Northbound Bond Connect in CIBM, such as chinese government bonds (CGBs); local government bonds (LGBs); policy financial bonds (PFBs); financial bonds; corporate bonds; negotiable certificate of deposits (NCDs), etc.

Master Agreement

Participants shall sign the repo master agreement in accordance with the relevant regulatory requirements. Relevant self-regulatory organizations and industry associations should file the standard version of the master agreement with the People's Bank of China (PBOC), the China Securities Regulatory Commission (CSRC), and other relevant financial regulatory authorities.

Upon signing of the master agreement, overseas institutional investors may engage in bond repo business through Northbound Bond Connect.

Upon signing of the master agreement, overseas institutional investors may engage in bond repo business through Northbound Bond Connect.

Types of Repo Transactions

CIBM's Repo transactions are categorized into two types: Pledged repo and Outright repo (also known as buy/sell back and repurchase). In the initial phase, Outright repo is applicable to overseas institutional investors, the underlying bonds can be transferred to repo buyers and reused by the repo buyer.

Outright repo is available in two formats: Single-Bond Outright repo and Multi-Bond Outright repo. The Multi-Bond Outright repo refers to a repo transaction which utilizes one or multiple bonds as collateral and supports timely coupon payments during the repo period.

Outright repo is available in two formats: Single-Bond Outright repo and Multi-Bond Outright repo. The Multi-Bond Outright repo refers to a repo transaction which utilizes one or multiple bonds as collateral and supports timely coupon payments during the repo period.

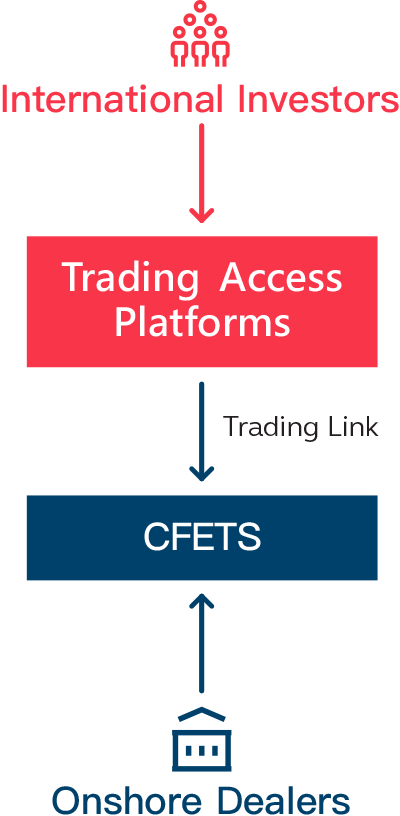

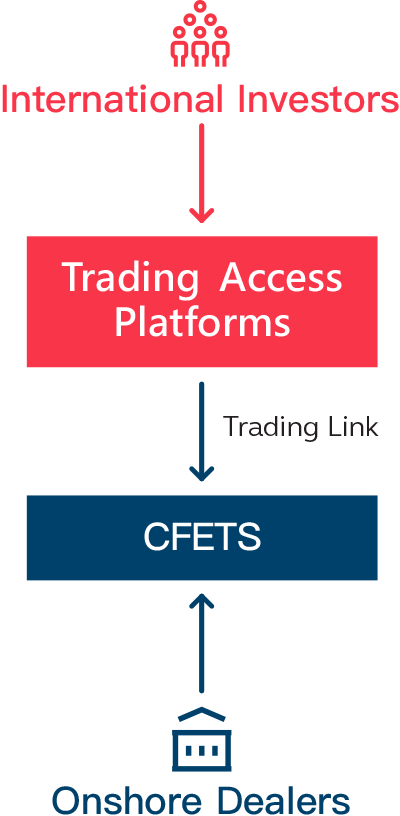

Trading System and Access Platforms

CFETS provides trading services for overseas institutional investors conducting repo transactions in CIBM, which are executed through the CFETS trading system. Trading links have been established with recognized trading access platforms, enabling overseas institutional investors to trade through familiar international interfaces.

Trading Protocol: Request for Quotation (RFQ)

Bond Connect investors can conduct Cross-Boundary Repo via RFQ (Request-for-Quote), of which the trading workflow is summarized below.

- Overseas institutional investors: Obtain tradable price quotes by sending out RFQs;

- Onshore market makers: Respond to the RFQ with tradable prices and other transaction factors via CFETS Trading System;

- Overseas institutional investors: Confirm trade by accepting the price quote. The trade is then executed on the CFETS Trading System;

- RFQ supports trade allocations to overseas institutional investors' subaccounts.

Clearing and Settlement

China Central Depository & Clearing Co., Ltd. (CCDC) and Shanghai Clearing House (SHCH) provide registration, custody and settlement services for overseas institutional investors engaging in bond repo transactions in CIBM.

Under the Northbound Bond Connect model, Hong Kong-based bond custody and settlement institutions recognized by the People's Bank of China and the Hong Kong Monetary Authority offer registration, custody and settlement services for overseas institutional investors conducting bond repo business in CIBM by connecting with CCDC and SHCH.

The maximum term for repo transaction conducted by overseas institutional investors in CIBM is 365 days. Settlement is conducted on a Delivery-versus-Payment (DVP) basis under the gross settlement mechanism.

Under the Northbound Bond Connect model, Hong Kong-based bond custody and settlement institutions recognized by the People's Bank of China and the Hong Kong Monetary Authority offer registration, custody and settlement services for overseas institutional investors conducting bond repo business in CIBM by connecting with CCDC and SHCH.

The maximum term for repo transaction conducted by overseas institutional investors in CIBM is 365 days. Settlement is conducted on a Delivery-versus-Payment (DVP) basis under the gross settlement mechanism.

Trading and Clearing Hours

The trading day follows the business day in the China Interbank Bond Market.

Trading hours are from 09:00-12:00 and 13:30–17:00 (Beijing time).

Settlement cycles include T+0, T+1, T+2, and T+3, with a cut-off time of 16:50 (Beijing Time) for T+0 settlement.

Trading hours are from 09:00-12:00 and 13:30–17:00 (Beijing time).

Settlement cycles include T+0, T+1, T+2, and T+3, with a cut-off time of 16:50 (Beijing Time) for T+0 settlement.

Risk Management

In terms of the quotas, the cash lending limit of market makers shall comply with the unified management framework for cross-border RMB interbank financing. The repo balance of overseas institutional investors shall comply with the regulations on the leverage ratio of Outright repo in the CIBM. The infrastructure in the interbank market will release detailed rules to clarify the specific requirements.

The net outstanding balance of cross-border interbank financing provided by market makers should not exceed 6% of the institution’s net Tier-1 capital or core net capital. The outstanding amount of repo financing is capped at 100% of the remaining bond holdings for sovereign institutions, RMB clearing banks and participating banks, and at 80% for other types of overseas institutional investors in the initial phase, subject to adjustments in the future.

The net outstanding balance of cross-border interbank financing provided by market makers should not exceed 6% of the institution’s net Tier-1 capital or core net capital. The outstanding amount of repo financing is capped at 100% of the remaining bond holdings for sovereign institutions, RMB clearing banks and participating banks, and at 80% for other types of overseas institutional investors in the initial phase, subject to adjustments in the future.

Settlement Failure Reporting

Where a settlement failure occurs, both parties shall promptly file an explanation with CFETS through CNYPlus Settlement Failure Reporting Service or other offline channels.